Minnetrista’s city council passed the final 2020 tax levy Monday night, increasing the levy 5.66% from the previous year, on a 4-1 vote. At our work session prior to the meeting I asked the council to consider using the unanticipated higher revenue from the city’s building permits to off-set the levy increase but the answer was a unanimous no. Despite a 43% general fund reserve (healthy by any standard) the council chose to apply the savings to the general fund reserve increasing it to 47%. I was the dissenting vote on the motion to pass the levy increase.

There are other reasons I dissented. Minnetrista has a backwards budgeting process where staff essentially submits a budget to the council and the council usually approves it without much modification. Generally we are given two or three budget options with varying increases (I’ve never seen an option without an increase that is far above our growth rate even considering inflation) and the council chooses one of the options as the preliminary tax levy in September and then adopts the final levy in December, which may vary slightly when year end projections are more certain.

In the private sector, as in many cities throughout the country, the budgeting process is different and begins with submitting the prior year’s budget and then justifying the increases, line by line, before adoption. That has not been the process in Minnetrista and there has been considerable resistance to the idea that it should be. How else can the council responsibly vote to support a tax levy if it doesn’t know what the justifications are behind all the increases? I’d like to see a budget committee comprised of two council members established to do this.

The budgeting process in Minnetrista needs to start out assuming every line-item increase, which isn’t just inflationary, needs justification. Until that happens I will be voting no, as I have in the past, on the city’s tax levy.

Minnetrista’s debt service is 18.6% of total government fund expenditures and that is high, according to Standard & Poors which

Minnetrista’s debt service is 18.6% of total government fund expenditures and that is high, according to Standard & Poors which  Because a city can just take the money out of constituents’ pockets it carries an obligation to make sure it manages debt responsibly. Even the Ehlers rep estimated Minnetrista would need to almost cut its debt service in half (reduce it to 10%) to change the S&P rating. Minnetrista needs to put the brakes on. Apparently so do a lot of other Minnesota cities.

Because a city can just take the money out of constituents’ pockets it carries an obligation to make sure it manages debt responsibly. Even the Ehlers rep estimated Minnetrista would need to almost cut its debt service in half (reduce it to 10%) to change the S&P rating. Minnetrista needs to put the brakes on. Apparently so do a lot of other Minnesota cities.

Omissions

Omissions

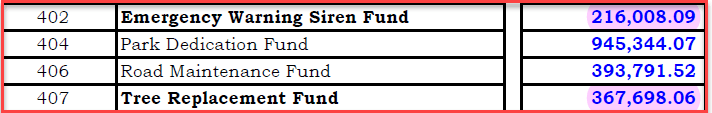

while cannibalizing our fund reserves, all the while having access to these public funds which, in my opinion, belong in our general fund reserves to give an accurate view of the city’s balance sheet. If the city needs to buy trees we can budget for them. If the city needs to purchase additional emergency sirens we can budget for them. Setting up “special funds” keeps this money out of the public’s view and, more importantly, out of the general fund and gives a distorted view of the city’s finances, which is used to justify tax increases year after year.

while cannibalizing our fund reserves, all the while having access to these public funds which, in my opinion, belong in our general fund reserves to give an accurate view of the city’s balance sheet. If the city needs to buy trees we can budget for them. If the city needs to purchase additional emergency sirens we can budget for them. Setting up “special funds” keeps this money out of the public’s view and, more importantly, out of the general fund and gives a distorted view of the city’s finances, which is used to justify tax increases year after year.

This information didn’t go over well with the incumbents who asserted these communities can’t be compared but it should be noted that the city of Orono is quite comparable to Minnetrista in size and growth yet their increase is 40% lower than Minnetrista’s. Yes, there’s always a chance preliminary tax levies may come down before they are adopted in December but I’d be shocked if Minnetrista’s increase came down to even Wayzata’s at 4.29%.

This information didn’t go over well with the incumbents who asserted these communities can’t be compared but it should be noted that the city of Orono is quite comparable to Minnetrista in size and growth yet their increase is 40% lower than Minnetrista’s. Yes, there’s always a chance preliminary tax levies may come down before they are adopted in December but I’d be shocked if Minnetrista’s increase came down to even Wayzata’s at 4.29%.