Last night’s council meeting was notable in that two “firsts” occurred. One, it was the first time since elected in 2016 that I voted to approve the city’s preliminary tax levy and the reason I did was it would actually result in a net decrease in most resident’s property taxes. Two, it was the first time Mayor Whalen voted for a preliminary tax levy that would result in a tax decrease since she was elected Mayor. I’d like to think it was because she knew it was in the best interests of Minnetrista property owners but something tells me this dichotomy with her past voting record won’t happen again for another four years if she’s re-elected.

I predicted here that this election year would prompt a political change of heart for a mayor facing a challenger in a community less than happy with the steady tax increases she’s supported every year.

One of the budgeting games played by administrative bureaucracies, since they’re always seeking to increase resources, is to under-estimate projected revenue and over-estimate projected expenditures in the budget. Doing so always ends up with a tax increase being the only way to “make ends meet.” We saw that in the council’s budget work sessions where, seeing that permit fee revenue was underestimated, I was successful in getting the city’s 2021 projections for permit fees increased to more accurately reflect a higher number based on past and anticipated growth. As a result we were able to add those dollars to the road budget without increasing anyone’s property taxes.

That’s a win-win. We don’t always need to increase taxes to pay for what we need.

I blogged about the

I blogged about the

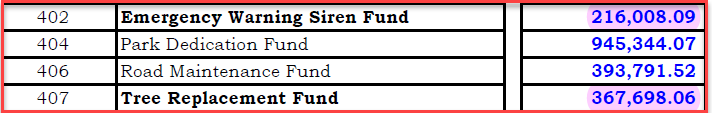

while cannibalizing our fund reserves, all the while having access to these public funds which, in my opinion, belong in our general fund reserves to give an accurate view of the city’s balance sheet. If the city needs to buy trees we can budget for them. If the city needs to purchase additional emergency sirens we can budget for them. Setting up “special funds” keeps this money out of the public’s view and, more importantly, out of the general fund and gives a distorted view of the city’s finances, which is used to justify tax increases year after year.

while cannibalizing our fund reserves, all the while having access to these public funds which, in my opinion, belong in our general fund reserves to give an accurate view of the city’s balance sheet. If the city needs to buy trees we can budget for them. If the city needs to purchase additional emergency sirens we can budget for them. Setting up “special funds” keeps this money out of the public’s view and, more importantly, out of the general fund and gives a distorted view of the city’s finances, which is used to justify tax increases year after year.

I’m going to go out on a limb here and assume the city’s *preliminary tax levy is not the most riveting topic of conversation at your dinner table. But what if you knew that you and your fellow Minnetrista taxpayers had socked away hundreds of thousands of dollars in an account, money that has been sitting there for years without any liabilities against it and none foreseeable, that could lower your city property taxes? Would that get your attention? It got mine.

I’m going to go out on a limb here and assume the city’s *preliminary tax levy is not the most riveting topic of conversation at your dinner table. But what if you knew that you and your fellow Minnetrista taxpayers had socked away hundreds of thousands of dollars in an account, money that has been sitting there for years without any liabilities against it and none foreseeable, that could lower your city property taxes? Would that get your attention? It got mine.