It was a very close election yesterday, but with voter turnout at only 35% the result can’t be assumed to reflect the wishes of the majority of school district residents. The whopper bond on Question #2 barely squeaked by with only a 110 vote lead out of 5,132 votes.

There is no question if this referendum had been held in an even numbered year, where voter turnout is typically 60-80%, it would have gone down in flames. But the Westonka school board knows that and realizes their ability to suppress opposition voting is much better during an off-year when other statewide races don’t draw their opposition voters to the polls.

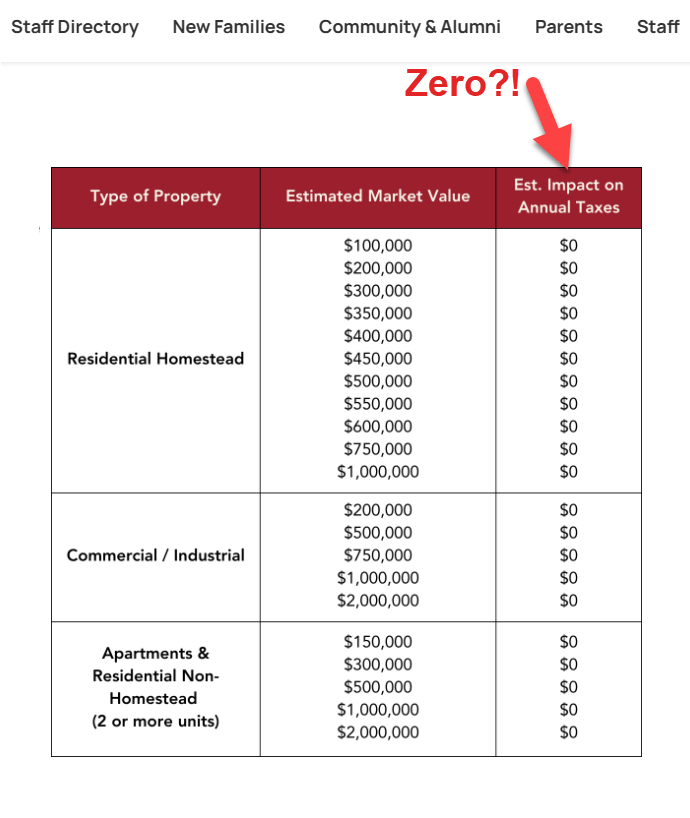

In addition, Question #2, which will increase district property taxes for the capital projects levy, passed as well and 100% of the incumbent school board members were reelected.

The only solution to repairing the public’s trust in school district elections is to require they be held in even numbered years, when voter turnout is higher and outcomes are more likely to represent the community as a whole. But that would require a school board that values the voice of the majority.

Since Westonka doesn’t have a school board that values the voice of the majority, the only vehicle to accomplish getting rid of these off-year, voter suppressive elections, is for residents to petition to have a referendum on the ballot requiring them to do so.

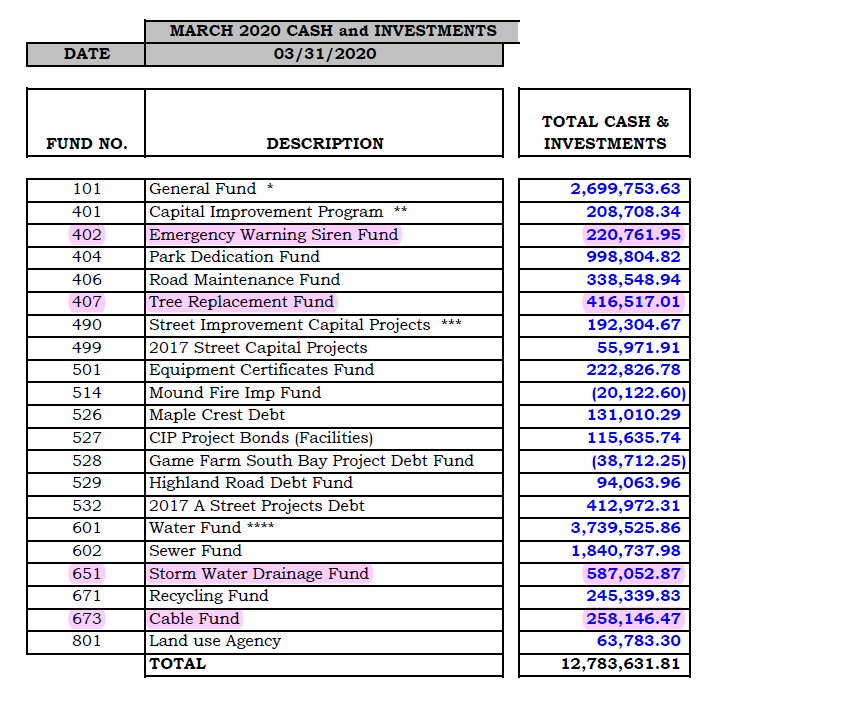

We are talking about the city’s tree fund that has a current balance of over $416,000, dollars contributed by developers that took out more trees than allowed and had to pay into the fund. That money has been sitting idle, not being used (Minnetrista has no shortage of trees) and the balance continues to grow, but once the city is developed the deposits to that fund will stop.

We are talking about the city’s tree fund that has a current balance of over $416,000, dollars contributed by developers that took out more trees than allowed and had to pay into the fund. That money has been sitting idle, not being used (Minnetrista has no shortage of trees) and the balance continues to grow, but once the city is developed the deposits to that fund will stop. Knowing this tree fund has been sitting unused for years I’ve suggested we should look at using part of it for road maintenance since that seems to be the most challenging aspect of our finances and is the primary reason given each year for increasing the tax levy. There are other “special” funds with balances of hundreds of thousands of dollars that have been sitting relatively idle for years as well (see highlighted chart).

Knowing this tree fund has been sitting unused for years I’ve suggested we should look at using part of it for road maintenance since that seems to be the most challenging aspect of our finances and is the primary reason given each year for increasing the tax levy. There are other “special” funds with balances of hundreds of thousands of dollars that have been sitting relatively idle for years as well (see highlighted chart).

That’s assuming, incorrectly, that for every percent in growth the city needs a 1:1 ratio increasing the tax levy. That’s simply not true. First, the 2-2.5% referenced here is the increase in the city’s total market valuation from new homes, not the number of new homes built. That could be a very small number of expensive homes or a lot of inexpensive homes. There is no correlation between market valuation increases and a need for higher taxes.

That’s assuming, incorrectly, that for every percent in growth the city needs a 1:1 ratio increasing the tax levy. That’s simply not true. First, the 2-2.5% referenced here is the increase in the city’s total market valuation from new homes, not the number of new homes built. That could be a very small number of expensive homes or a lot of inexpensive homes. There is no correlation between market valuation increases and a need for higher taxes.

I blogged about the

I blogged about the